Topo

Finance Law for 2021 – discover the highlights

Date de publication : 15.02.21

The new Finance law for 2021 is obviously largely influenced by the current crisis with measures aiming at supporting the businesses during this difficult period, but it also provides significant measures on more structural issues like :

• Developing the industrial projects with significant reductions in related taxes ;

• Stimulating the environmental expenses for cars and buildings through tax credit or tax reduction.

The new law is also bringing precisions on the timeline for the implementation of electronic invoices for B to B businesses. As a summary it supports, prepares the aftermath of the crisis and, although State’s deficits and debt are extremely high, does not implement any new or increased taxes.

A new more recent article is online : Finance Law for 2022 – discover the highlights

Tax measures related to the Covid crisis

A new possibility to increase equity without being taxed, which may facilitate raising debt.

Balance sheet revaluation

Objective : will allow companies to restore their equity with neutral tax impact

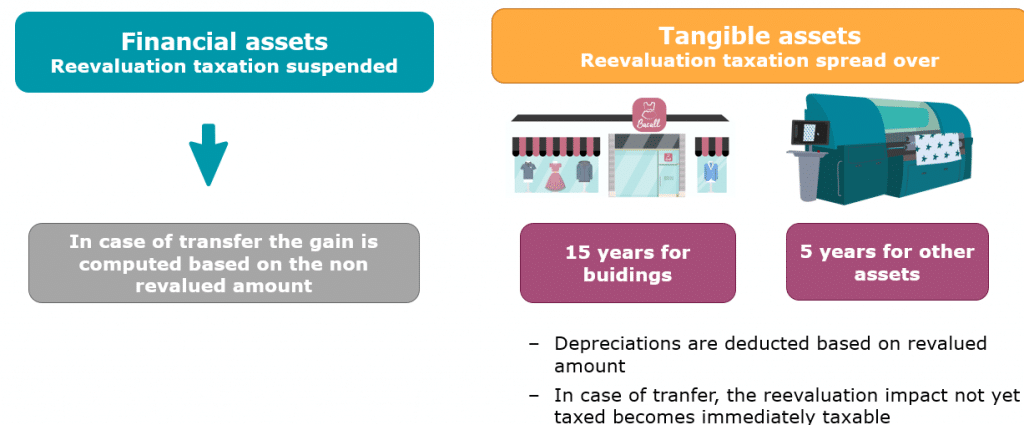

- Reminder on existing reevaluation rules :

- Apply only to tangible fixed assets and financial investments (intangible assets are excluded)

- Related increase in equity is immediately taxed. Compensation with existing tax losses carried over is capped to 1 M€ plus 50% of additional taxable income

- New modalities applicable for revaluations performed for fiscal years ending between December 31, 2020 and December 31, 2022

- Deferral of the reevaluation taxation

- Specific option to be made by the tax payer

Tax neutral scheme

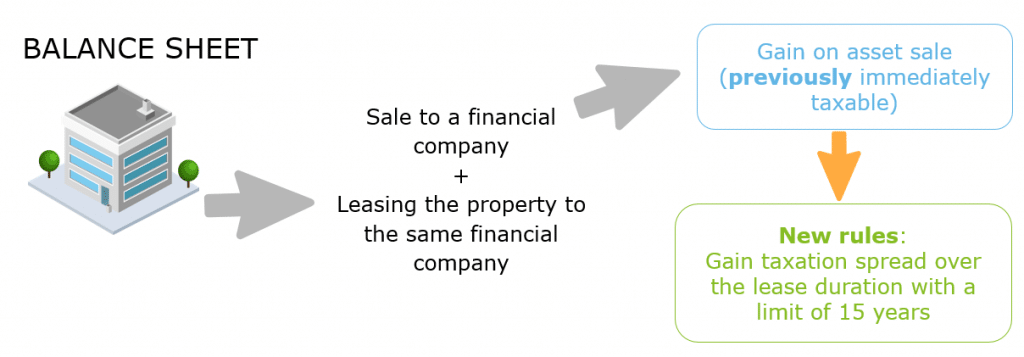

Lease-back on real property

Lease back transaction is a mean to get significant amounts of cash. The new law reduces the immediate tax impact.

Objective : will reduce the tax impact on sales lease back transactions

Existing rules provided that the gain on the sales was immediately taxable

This measure applies to real properties :

- Used by the lessee for commercial and industrial purposes

- Whose disposal to the financial company

- Occurs between January 1, 2021 and June 30, 2023

- Follows a financing agreement accepted by the lessee between September 28, 2020 and December 31, 2022

Tax credit related to waivers of real property rents

Measure to incentive the lessors to waive rents in favor of lessees strongly impacted by the crisis.

Scope

- Applicable to lessors who, as of December 31, 2019, were not in financial distress as defined by EU regulation UR 651/2014 dated June 17, 2014.

- Only waivers for rents related to November 2020 month, granted before December 31, 2021.

- When lessor and lessee are related parties, the lessor must justify the cash difficulties encountered by the lessee.

Lessee’s conditions

- Facilities closed during November due to State’s decisions or lessee’s main activity being part of the S1 list (hotel, restaurant, bar, tourism, event industry, sport and culture, air transport)

- Headcount below 5 000 at group level

- Not in financial distressed situation as of December 31, 2019 as per EU regulation (with the exception of small companies : headcount below 50 and sales or total assets below 10 M€)

- Not in judicial bankruptcy as of March 1, 2020

Computation of the tax credit

- 50% of the rents waived

- For lessees with headcount above 250 and below 5000, only 2/3 of the rents waived are subject to tax credit

- Total tax credit is limited to 800 K€ (EU ceiling on State aids)

Social contribution measures related to Covid crisis / Extensions of specific reductions / exemptions

Following the measures of the last quarter of 2020, a new set of financial aids has been implemented

- Exemption of employer’s contributions

- Aid « Aide au paiement » for paying employee’s contributions

- Reduction of contributions related to directors

- Refinancing plans

Exemption of employer’s contributions

Employers in scope

Headcount below 250

- Operating in (i) specific sectors (S1) : tourism, hotel, restaurant, culture, air transport, and professional events, or (ii) other sectors closely connected

- Are specifically included (i) those having their facilities closed down due to administrative decision or (ii) those having incurred a decrease in sales of at least 50%

Headcount below 50

- Operating in other sectors when their offices have been subject to administrative measures prohibiting public reception, this impacting significantly the continuation of their activities

Which periods ?

Entities subject to curfew

- Exemption applicable to working periods starting September 1, 2020 for companies of S1 sectors with locations in curfew areas. Measures decided before October 30, 202

Entities impacted by the second lockdown

- Exemption applicable to working periods starting October 1, 2020

- For employers operating in places affected by measures regulating or prohibiting (i) the movements of persons or (ii) receiving the public. Measures decided on or after October 30, 2020

• The Finance Law provides that it can be extended by decree

Which contributions?

- Contributions paid to URSSAF (health, unemployment and retirements)

- Other contributions (complementary health and retirement, death and disability) are excluded

Which employees?

- Excludes corporate officers

Aid « Aide au paiement » for paying employee’s contributions

« Aide au paiement » Covid 2 (September to November 2020)

- As for Covid 1, the aid represents 20% of the salary amounts included in the scope of this aid (remunerations subject to social contributions)

- It can be applied against the amounts of social contributions due for the years 2020 and 2021, after taking into account other applicable exemptions

« Aide au paiement » Covid 1 (March to May 2020)

- Companies who were not able to apply these aids against social contributions in 2020 are allowed to use these credits against 2021 social contributions

Reduction of contributions related to directors

- For directors falling under the social security regime applicable to employees, the Finance law provides a reduction in social contributions for the years 2020 and 2021

- The reduction is a specific amount defined by decree (information provided in the DSN)

- The conditions to benefit from this reduction are similar as the ones required for the employees

Refinancing plans

Implementation of refinancing plans for 2020 outstanding payables

- For the first lockdown, in June 2020, the law provided the possibility for the companies to implement rescheduled payment terms without penalties for the social contributions due on June 30, 2020

- The 2021 Finance Law for the Social Security extended this possibility for the contributions remaining due as of December 31, 2020

Implementation up to March 31, 2021

- The plans will be implemented (i) either based on proposal from the social security representatives communicated the latest on March 31, 2021 or (ii) on request of the company issued before March 31, 2021

Corporate income tax

R&D tax credit – Change in activities outsourced to State bodies

Reminder of previous rules

- Companies incurring R&D expenses can benefit of a tax credit representing 30% of related expenses up to 100 M€ and 5% beyond 100 M€

- R&D expenses outsourced to State bodies were multiplied by 2 in the tax credit basis, providing there is no dependence link between the company and the State body

- Total outsourced expenses included in the annual tax credit basis are limited respectively to (i) 10 M€ for expenses from State bodies and (ii) 2 M€ for private entities being R&D accredited (total of 12 M€)

New rules applicable starting January 1, 2022

- Expenses outsourced to State bodies will not be doubled anymore in the tax credit computation

- They will be limited to 3 times the amount of other expenses included in the tax credit computation

- The total annual limit for external expenses has been reduced to 10 M€

Tax credit related to energy renovation of professional buildings

New tax credit for expenses improving the energy efficiency of the buildings.

Scope

- Applicable to companies considered as SME as per EU definition : headcount < 250 and revenues < 50 M€ or total assets < 43 M€

- Energy renovation works still subject to precisions from future ministerial decrees will cover :

- Acquisition and installation of thermal insulation systems

- Acquisition of other equipment’s like collective solar water heater, biomass boiler, etc.

- Buildings for tertiary use, constructed at least 2 years before the renovation expenses

- Buildings used in the business of the tax credit beneficiary

Computation of the tax credit

- 30% of eligible expenses

- Total expenses capped to 83 333 € for the period October 1, 2020 to December 31, 2021 => maximum tax credit of 25 000 €

- Tax credit not compensated with CIT payable can be reimbursed by the Tax authority

Reduced income tax (15%)

Extension of the beneficiaries

- Reminder

- Companies with annual sales below 7 630 K€, pay a 15% corporate income tax on the first 38 120 € of their taxable income

- Other conditions include (i) capital amount fully paid and (ii) 75% of shareholders are individuals (either directly or indirectly providing the parent company sales are below 7 650 K€)

- Starting FY2021, the annual sales threshold increases from 7 630 K€ to 10 000 K€

- Other conditions remain identical

To discover : Overview on French tax system

VAT

VAT and complex transactions

Clarification of the applicable treatments adopting EU jurisprudence

- This formalizes a set of rules already largely followed by the Tax authority

- Art. 257 of the French tax code defines the complex transactions as follows :

- Transactions including several components which are such a closely linked that they represent only one global economical service

- One principal service provided together with ancillary services

- These definitions should be considered from the client stand point

- The treatment described in the following slide is applicable starting January 1, 2021

- Transactions including several components which are such a closely linked that they represent only one global economical service

- If the different components are subject to different VAT rates, the highest one should be applied on all components

- One principal service provided together with ancillary services

- The rate applicable is the one of the principal service

- If the rate applicable is 2,1%, then the ancillary services remain subject to their specific rates

E-commerce

Postponement of the implementation of new rules related to VAT applicable on e-commerce

- These rules applicable to B to C sales, initially planned for January 1, 2021 have been delayed on July 1, 2021 : postponement due to the Covid 19 crisis

- Starting July 1, 2021, the sales intra-EU will be subject to (i) French VAT for total sales up to 10 000 € and (ii) the customer’s country VAT rate(s) for sales above 10 000 €

- Up to July 1, 2021, each country has its own amount beyond which foreign sales are subject to their VAT rates (i.e : 35 000 € for France)

- Creation of a European online counter (One Stop Shop – OSS) for :

- Sales intra-EU (goods)

- Services subject to VAT of the client’s country

Implementation of electronic invoices

Significant project for the Tax authority to collect and control VAT. Planning for B to B is now on track.

- Finance Law for 2020 planned the implementation of electronic invoices between VAT registrants and their communication to the Tax authority

- This measure will be implemented for B to B transactions as follows :

- Starting January 1, 2023 with the obligation for the enterprises to accept such invoices

- Between 2023 and 2025, the obligation for the enterprises to issue such invoices and communicate them to the Tax authority, depending on their size

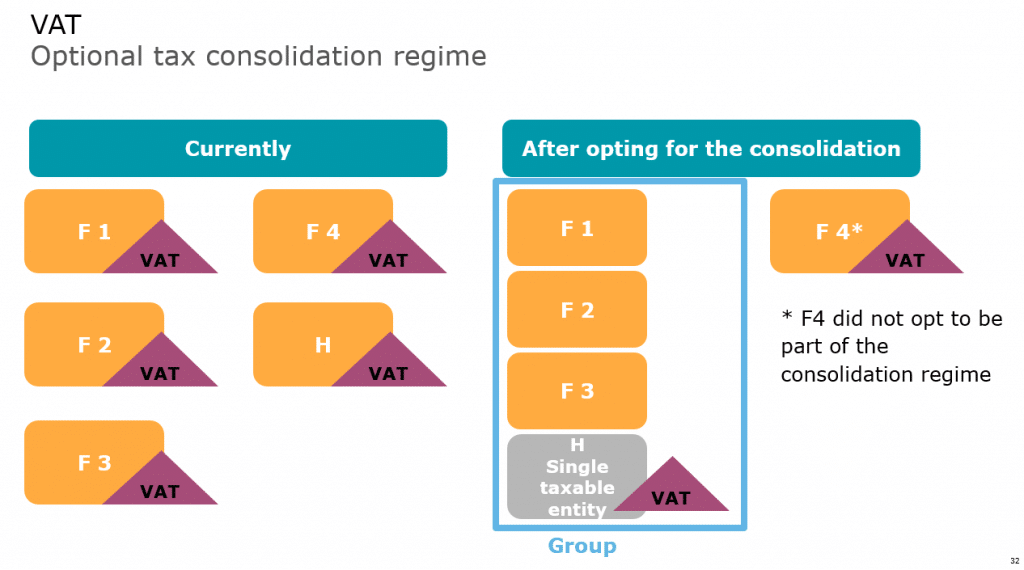

Optional tax consolidation regime

After corporate income tax, we have now a tax consolidation regime for VAT.

Key features of the regime

- Possibility to opt for a group taxable entity and for a 3 years period. Option to be exercised before October 31 of the previous year

- Covers all types of activities – Companies with links in term of financial (at least ownership or voting rights of 50%), economic (activities interdependent or with a common objective) and organization (same management or resources)

- Neutralization of transactions between group members

- Scope of the tax consolidation should comply with certain rules with the possibility to exclude entities meeting the requirements

- Option can be exercised starting January 1, 2022, with the regime applicable starting January 1, 2023

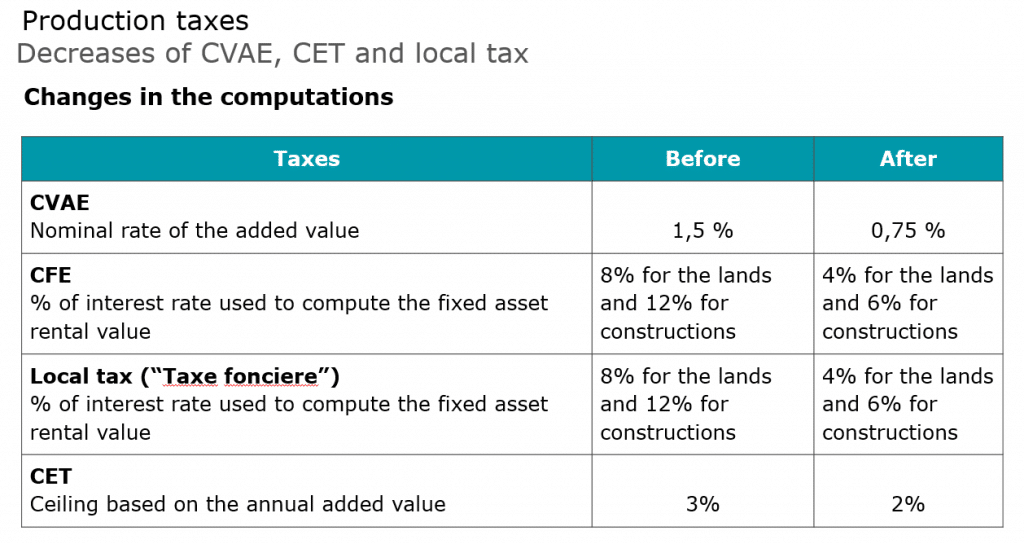

Production taxes

These are taxes impacting significantly the industrial activities : CET and local tax.

Decreases of CET and local tax

Reminder of the current situation

- The CET is composed of the taxes CVAE and CFE computed as follows :

- CVAE represents 1,5% of the annual added value for companies with sales above 50 M€ (lower rates when sales are below 50 M€)

- CFE represents a % (defined by city) of the rental value of the fixed assets used by the company

- Total CET tax is capped to 3% of the annual added value

- Local tax (“taxe foncière”) is based on a % of the rental value of fixed assets owned

The CVAE is based on added value which has a strong impact on industrial activities whose cost structure is largely made of equipment’s (depreciation) and labor.

Changes in the computations

Everything is basically divided by 2.

Exemption of CET in case of new facility or extension of existing one

A new 3 year exemption

- This exemption is either granted by law (first year in case of creation) or subject to a decision by vote from the local authority’s council

- When subject to a decision from the local authority, it has a 3 years duration starting :

- The year following the creation

- The second year following the extension

- It applies to creations and extensions realized starting January 1, 2021

- Extension of a facility corresponds to the tax basis increase compared to the previous year, restated from reevaluation index applied from year to year

Other taxes

TASCOM reduction

Tax impacting the retail activities with a fixed amount per square meter depending on the amount of sales / square meter.

Current situation

- Tax applicable to stores with a commercial surface (i) above 400 square meters or (ii) below 400 square meters if part of a distribution network operating under a unique brand with a consolidated surface above 4 000 square meters

- Reduction of 20% for stores with surfaces between 400 and 600 square meters

Extension of the 20 % reduction starting January 1, 2021

- The Finance Law extended this reduction to stores with commercial surface below 400 square meters, if part of a distribution network operating under a unique brand with a consolidated surface above 4 000 square meters

- This new measure is applicable if the store revenue per square meter does not exceed 3 800 €

Car taxes (TVS)

Reduction in favor of less polluting cars.

Overview

- Tax paid per car owned or leased by the company with 2 specific components

- Component 1: based on CO2 emission rate or power level (administration table)

- Component 2 : date of first entry into service and type of fuel

- The computation has been amended for 2021 in favor of low polluting vehicles

- This tax will be cancelled in 2022 and replaced by others

Main adjustments for 2021

Exemption of component 1

- Beyond hybrid vehicles (electric and certain gasoline) already in place, the exemption concerns :

- Vehicles combining (i) hydrogen and (ii) natural gas, liquefied petroleum gas, gasoline or E85 superethanol

- Vehicles combining (i) natural gas or GPL and (ii) E85 superethanol

Exemption of component 2

- Beyond electric vehicles already in place, the exemption is extended to vehicles whose energy is exclusively hydrogen or is combining hydrogen and electricity

A propos de L'auteur

Partagez cet article

Vous avez aimé cet article, vous avez une question ? Laissez un commentaire