Article de Blog

Finance Law for 2022 – discover the highlights

Date de publication : 22.03.22

Finance law for 2022 is still influenced by the sanitary crisis with the adaptation of existing measures to support the businesses and facilitate their recovery.

In the meantime, and despite the State’s financial situation, the law confirmed the previous plans to reduce corporate income tax and production taxes and also reinforced the tax incentives related to innovation activities with additional or extended tax credits.

In addition to the finance law this presentation also includes a sample of significant recent tax jurisprudences for businesses.

Corporate income tax

Deduction of goodwill depreciations

Tax positions were unclear on the depreciation deductions indeed, since 2018 French accounting rules have been implemented for goodwill amortization based on (i) limited economic life, (ii) impairment test and (iii) 10 years option for SME’s. Then, the recent decision from the “Conseil d’Etat” rejected the principle of tax deduction.

The new Finance law for 2022 follows Conseil d’Etat’s position (no deduction) with a temporary measure for goodwill’s acquired between January 1, 2022 and December 31, 2025.

- It will be possible to deduct goodwill amortizations in accordance with accounting rules.

- In case of recurring and non-recurring depreciations, mechanism to limit the deductibility to the normal amortization plan

Tax lossed carried back

To some extent tax losses can be offset against income tax paid the previous year. The new Finance law for 2022 adapts the rules applicable for fiscal years closed starting December 31, 2022. Tax losses cannot be applied anymore against taxable income related to a CIT offset with specific tax credits (sponsorship, contributions to media companies and, provision of a bicycle fleet).

Example of a company having a FY20 taxable income of 500 K€ and tax reduction of 40 K€. FY21 tax losses will be applied on FY20 taxable income within the limit of 500 – 40/28% = 357 K€.

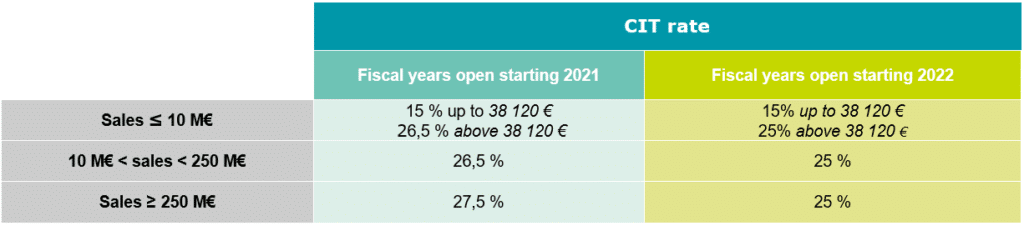

CIT rate evolution

Another point is that, there are no change brought by Finance Law 2022 on CIT rate evolution planned several years ago: 25% is the last downward step applicable for FY22. The minimal rate of 15% for taxable income up to 38 120 € remains applicable to small companies with sales below 10 M€.

Innovation activities

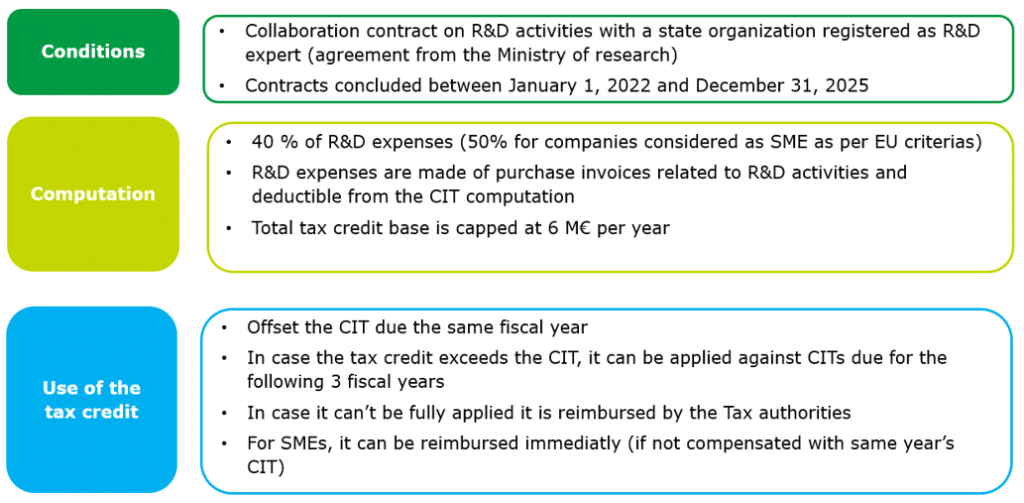

New tax credit related to R&D activities with state research organizations

Expenses included in this tax credit are excluded from the standard R&D tax credit computation (30%).

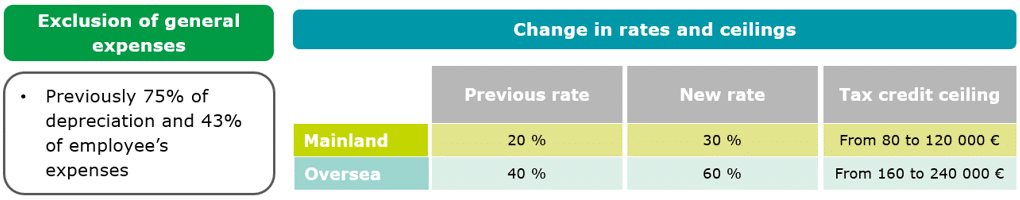

Changes in Innovation tax credit

- Rules applicable to expenses incurred starting January 1, 2023

- Extension of the tax credit up to December 31, 2024

New computations :

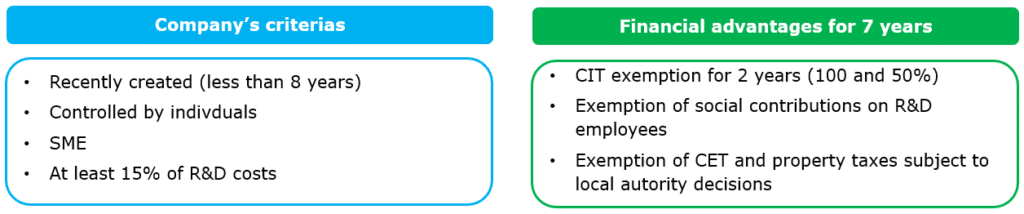

Young innovative companies (JEI)

JEI statute provides significant financial advantages to companies meeting specific criteria.

Extension of the period subject to the CIT exemption from 7 to 10 years starting January 1, 2022.

Covid measures

Bank loans

Since March 16, 2020, and to support businesses during the crisis, the French state has provided financial guaranties to the loans granted by financial entities to businesses registered in France. This measure was implemented and extended up to December 31, 2021.

Eventually the decision to further extend this measure up to June 30, 2022. This extension will be in force when EU’s decision will confirm its compliance with EU’s legal framework.

Social contributions

Since March 2020 the government implemented 3 successive plans to support certain sectors and size of companies with the following aids :

- Exemption of employer social contributions,

- Social security credits (« aides au paiement »), computed based on a % of gross salaries, to be applied against social contribution liabilities within defined time limits.

The last set implemented in October 2021 covered the working periods of June and July 2021 with only a Social security credit of 15%. This credit was to be used against FY21 social security contributions.

The remaining Social security credits can be used against FY22 social security contributions.

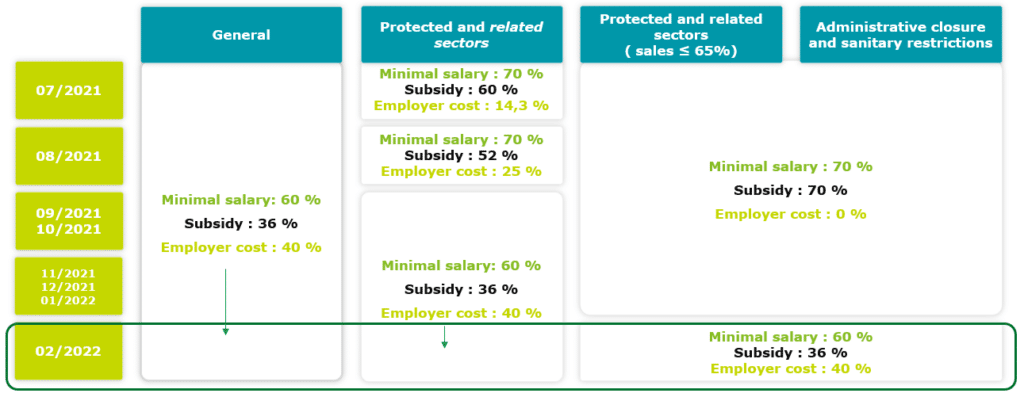

Financing non-working employees

Businesses hurted by the crisis with significant activity reduction had the possibility to implement partial working schemes with financial contributions from the social security

- These schemes have been subject to several decrees with defined terms, the last one being in December 2021 with a term at the end of January 2022,

- Salaries paid are limited to 60 to 70% of the normal salary (limited to 4,5 * minimal salary), the employer having the possibility to compensate up to 100%, the complement being free of social contributions (except 6,7% CSG and CRDS).

Exemption of social contributions for the employer maintaining the employees’ salaries is extended up to December 31, 2022 (with exception of 6,7 % CSG and CRDS).

VAT

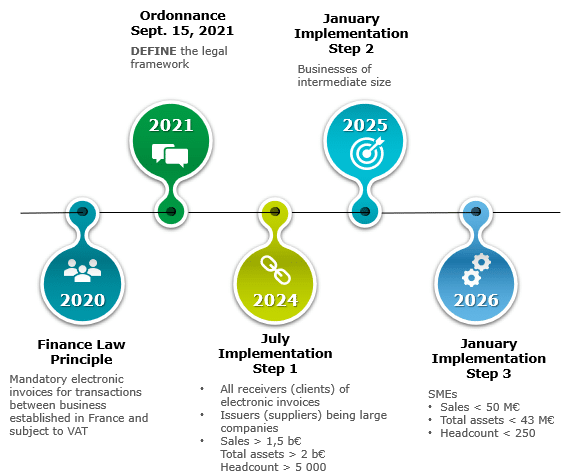

Reminder on electronic invoices – Planning and modalities

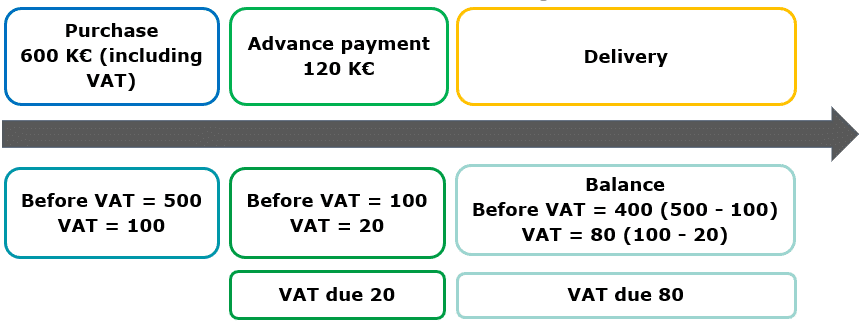

Advance payments on sales of goods

Previously, VAT on sales of goods was due only when goods were delivered. Starting January 1, 2023, VAT becomes due in case of advance payments received.

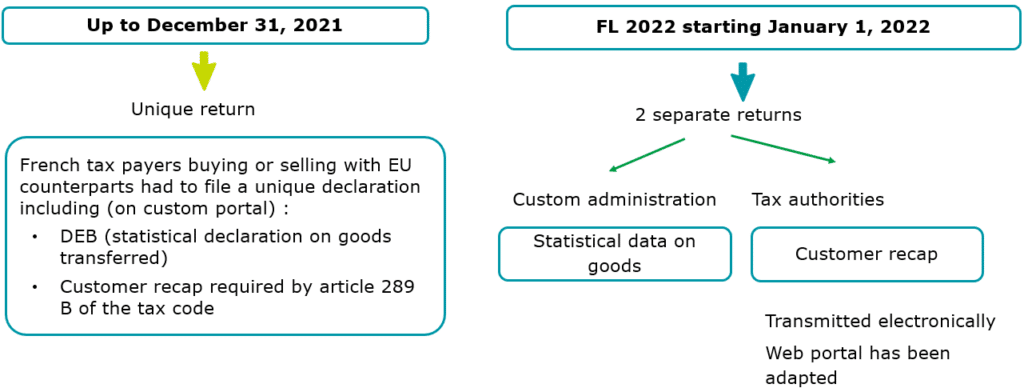

Intrastate returns : change in the filing process

Imports

Since January 1, 2022, management and collection of VAT related to imports have been transferred from the customs to the tax department, for all French tax registrants. The new process for VAT registrants, consists in paying / declaring simultaneously the VAT on imports with an automated input.

As a result, VAT on imports will not be paid anymore to custom offices, and will be collected / deducted on the same VAT return (except for businesses not subject to VAT).

The 14th of each month, online VAT returns will be pre-populated with import VAT related to the previous month (based on custom declarations). These information’s are to be checked by the taxpayers who will find the details of the transactions declared on a new specific space of the custom website douane.gouv.fr.

Information’s / guidance on the new process :

Look the tax authorities website

Optional tax consolidation regime

Reminder : key features of the regime implemented by Finance law 2021

- Possibility to opt for a group taxable entity and for a 3 year period. Option to be exercised before October 31 of the previous year

- Covers all types of activities – Companies with links in term of financial (at least ownership or voting rights of 50%), economic (activities interdependent or with a common objective) and organization (same management or resources)

- Neutralization of transactions between group members

- Scope of the tax consolidation should comply with certain rules with the possibility to exclude entities meeting the requirements.

Option can be exercised starting January 1, 2022 and up to October 31, 2022, for a first implementation starting January 1, 2023.

Financial activities

Businesses with financial activities (e.g : bank) were subject to general VAT exemption with the possibility to opt for certain activities. In case of option, the VAT had to be applied on all transactions, whatever the VAT situations of the related customers.

From now on in case of option, the VAT will be applicable per transaction, which will allow the companies to optimize their operations (commercial and costs), although it may generate more complexity for managing the input VAT. Measure applicable starting January 2022.

Other

Withholding taxes on certain services

Revenues paid to foreign entities on certain services (art, engineering, architect, etc.) may be subject to withholding taxes. This should also be analyzed with applicable bilateral tax treaty, if any.

With the Finance law for 2022, the revenues subject to withholding tax should now be considered net of charges, these latest being estimated to 10% of the revenues. If the company can justify that actual charges are higher than 10% of the revenues, it can claim the reimbursement of the corresponding withholding tax overpayment.

Non-compliance with billing requirements

Businesses not complying with the obligation to issue an invoice were subject to a 50% fine (on related sales value), this fine being reduced to 5% when the taxpayers justified that the transactions were properly accounted. The fines are now capped to 375 K€ per year to be reduced to 37,5 K€ when the transactions have been properly accounted.

To read more : Did you say reliable audit trail ?

Recent jurisprudences

Statistical allowance on trade receivables

Allowances on trade receivables are deductible when the related risks are properly justified either through specific analysis or statistical observations. The statistical approach was accepted by the Tax authorities when properly documented and covering receivables with already a risk profile (e.g: more than 6 months overdue).

In the case analyzed (consumer credit activities), the Tax authorities rejected the allowance based on a statistical approach for receivables overdue since less than 3 months.

The Conseil d’Etat ruled in favour of the tax payer (February 2020) as his approach was adapted to its business (large number of small receivables) and properly documented (3 years of statistical observations of homogeneous receivable populations).

Double taxations on capital gains

Capital gains related to the disposal of investments representing at least a 5% shareholding and being owned since at least 2 years are exempted from CIT, except a 12% portion of the gain (“Quote part frais et charges”).

When the shares sold relate to a foreign company, certain countries tax the capital gains even when earned by a foreigner. This situation resulted with a double taxation in France (12% portion) and abroad, as the French tax authorities never accepted to compensate both taxes.

The « Conseil d’Etat » ruled (highest tax court) against the Tax authorities (November 2021), and taxpayers in this situation are now entitled to benefit from a foreign tax credit (tax paid abroad) which can be applied to offset the 12% portion due in France.

Deduction of interest expenses on intercompany loans

Interest of intercompany loans are deductible in the limit of the average variable rates for bank loans of at least 2 years maturity (1,15 % for FY21). This limit can be increased if the borrower demonstrates that the rate he would get from a bank is higher.

In the case analyzed, the taxpayers justified the rate of his parent company loan (5,5% to be compared with the standard limit of 2,8%) with the bank loan rate obtained by a sister company (4,6%).

The « Conseil d’Etat » ruled in favour of the Tax authorities, as the sister company business was different, and the bank rate should be reduced with insurance and other costs not contemplated in the intercompany loan rate.

Withholding taxes applicable to maintenance services

Royalties and services related to intellectual property are generally subject to withholding taxes when rendered to foreign clients, although this could be customized in specific provisions of the bilateral treaties.

In the case analyzed, a software company was selling maintenance services to foreign clients who, in certain countries, were applying a withholding tax. The French Tax authorities refused to consider these withholding taxes as tax credits as they were not related to intellectual property.

The « Conseil d’Etat » ruled in favour of the Tax authorities (June 2021) as, differently to the software licenses, the maintenance services do not imply any transfer of know how.

As a result, both services should be clearly distinguished in the sales contract and their treatment in term of withholding taxes should be clarified with the foreign clients.

A propos de L'auteur

Vous avez aimé cet article, vous avez une question ? Laissez un commentaire