Topo

Financial law for 2023

Date de publication : 21.04.23

The finance law for 2023 navigates between the goals to provide support to businesses impacted by the crisis, to improve the country competitivity and the need not to deteriorate the State’s finances.

As a summary, the main features of this law are focusing at :

· Addressing the crisis situation related to the Ukrainian war and the rise of inflation;

· Extending financial support for apprenticeship and reduce youth unemployment;

· Keeping planned tax reductions on track.

Crisis-period support measures

Extension of « Resilience » state-guaranteed loans (PGEs)

The PGE state-guaranteed loan was introduced as a means of supporting companies’ cash flow by French law no. 2020-289 of 23 March 2020, which authorizes the state to guarantee certain bank loans. This measure was initially deployed to respond to the COVID-19 crisis up to 31 December 2020 (extended to 30 June 2022).

In order to support companies affected by the economic consequences of the war in Ukraine, the government introduced, alongside the « Covid » PGE, the “Resilience” PGE, which is in force until 31 December 2022.

The Finance Act for 2023 extends the “Resilience” PGE scheme until 31 December 2023 to help businesses continue operating at a time of uncertainty and inflation.

Electricity buffer and shield

2023 support measures to address the unprecedented rise in electricity prices :

| The price shield | The electricity buffer |

| For VSEs eligible for regulated tariffs : | For the following entities not eligible for the price shield : |

| · fewer than 10 employees, · revenue of €2 million, and · with an electricity meter with a power capacity of < 36 kVA | · Private legal entities employing fewer than 250 people, with revenue < €50 million or total assets < €43 million · Public legal entities employing fewer than 250 people, with revenue < €50 million · Public or private legal entities with more than 50% of revenue derived from public financing, earmarked taxes, donations or contributions · Local authorities and their associations |

The relief is applied directly by the electricity supplier and is included in the electricity bill.

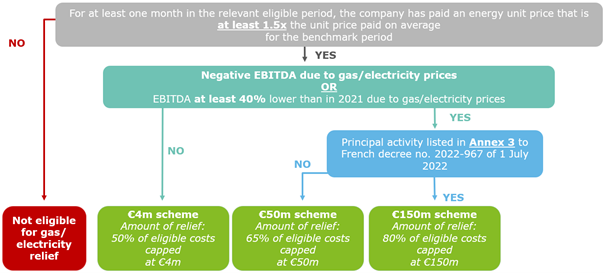

Relief for energy-intensive companies (Gas and Electricity)

“Gas and electricity” relief can be combined with the electricity buffer, provided that the company is eligible for “gas and electricity” relief once the buffer has been taken into account.

Who’s eligible persons ?

- The company was created before 1 December 2021

- The company was not subject to legal proceedings on insolvency

- The company has no outstanding tax or social security liabilities as at 31 December 2021, apart from any that have been settled or are covered by a payment plan when the claim for assistance was made

- For associations only: are subject to business taxes or employ at least one person

- The company is resident in France for tax purposes and carries out an economic activity

To discover : Study on the electronic invoicing in Europe

The company is “energy intensive”

For the € 4 million scheme

Company whose energy costs for the relevant eligible period or for one month of the relevant eligible period represent at least 3% of the revenue generated in the same month in 2021 or in the same months of the eligible period in 2021 (i.e. prorated 2021 revenue).

For the €50 million and €150 million schemes :

Company whose energy costs for the benchmark period represent at least 3% of the revenue generated in the reference period or whose energy costs for the first half of 2022 represent at least 6% of the revenue generated in the first half of 2022.

The scheme was extended until 31 December 2023 by creating six further eligible periods (French decree no. 2022-1575 of 16 December 2022).

Companies : Common provisions

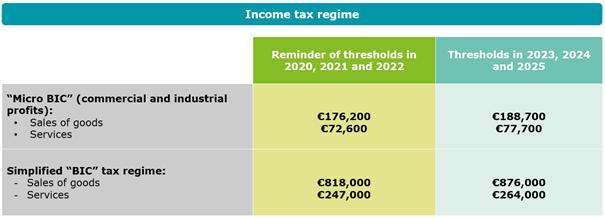

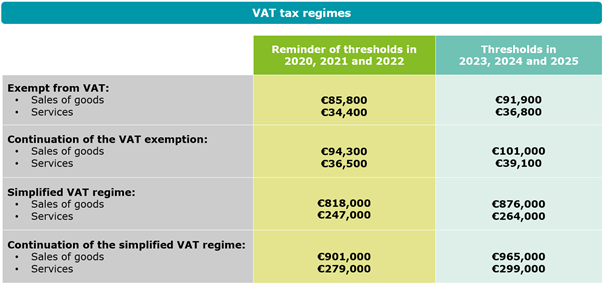

Thresholds are reassessed every three years

The thresholds for the micro-enterprise regime, the VAT base exemption regime, the simplified tax regime and the simplified VAT regime are reassessed every three years (in line with the three-year change in the first bracket of the income tax scale).

The reassessment covers the three-year period of 2023, 2024 and 2025.

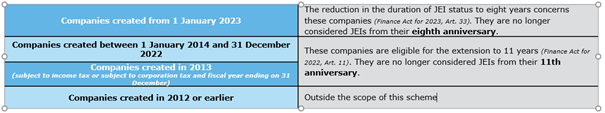

Extension and adjustment of the young innovative enterprises (JEI) scheme

The scheme is extended to 31 December 2025 (exemption from income tax/corporation tax, property tax, local economic contributions (CET) and employer social insurance and family allowance contributions).

Companies must meet a number of criteria in order to benefit from this scheme.

The 2023 Finance Act changes the condition relating to the age of the company (concerning the income tax exemption only) such that only companies created less than eight years ago are able to benefit from JEI status

This adjustment applies only to companies created from 1 January 2023 and does not affect existing JEIs.

The reduced corporation tax rate of 15% applies to companies subject to corporation tax (automatically or optionally) with revenues excluding VAT of €10 million or less and whose fully paid up capital is at least 75% owned by natural persons.

The ceiling on profits subject to the reduced corporation tax rate is increased from €38,120 to €42,500. The eligibility conditions for the reduced corporation tax rate are unchanged.

Unless otherwise provided, this increase applies to corporation tax due for financial years ending after 31 December 2022. This change in the ceiling saves eligible companies a maximum of €438 in corporation tax [(42,500 – 38,120) x (25% – 15%)].

Companies subject to corporation tax

Prior to the adoption of the French law of 14 February 2022, individual business owners did not have the option to pay corporation tax

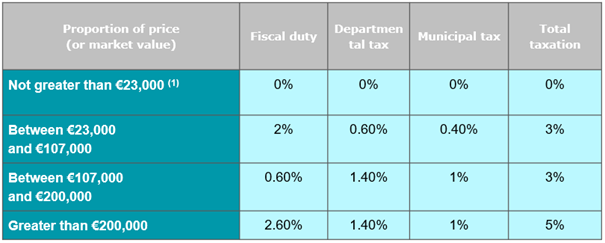

Disposals of business assets and goodwill were subject to the duty provided for in Article 719 of the French General Tax Code (fiscal duty collected by the state) plus additional departmental taxes (French General Tax Code, Article 1595) and municipal taxes (French General Tax Code, Article 1584 and 1595a).

These provisions continue to apply to disposals of business assets and goodwill of individual business owners that are not subject to corporation tax.

From 2023, disposals of individual business owners that have opted to be treated as single-owner limited liability companies (EURLs) (and to pay corporation tax) are treated in the same way as sales of shares. (French General Tax Code Article 726).

Article 726 of the French General Tax Code does not specify what the taxable base is. It is likely to be the total net sale price. The law does not specify whether an allowance of €23,000 applies to the taxable base (as it does for a transfer of shares). We will await the tax authorities’ comments on these matters.

The applicable rate is 3%. The rate may rise to 5% if the company’s main activity is real estate.

Companies : VAT

System in force up to 31 December 2022 :

For supplies of tangible goods, the trigger event for paying (or deducting) VAT occurred “when the goods were delivered”. The delivery of a good corresponds to the transfer of ownership. Therefore, collecting an advance payment for the supply of goods did not trigger VAT payment on the amount received.

Compliance with EU law :

The VAT Directive (Directive 2006/112/EC of 28 November 2006) states :

- in Article 63, that the trigger event shall occur and VAT shall become due when the goods and the services are supplied,

- in Article 65, that where a payment is to be made before the goods or services are supplied, VAT shall become due on receipt of the payment and on the amount received.

The non-compliance of French law was highlighted by a ruling of the Nantes Administrative Court of Appeal of 28 May 2021 (no. 19NT03579).

System in force since 1 January 2023

The Finance Act for 2022 drew the necessary conclusions from this case law and brought domestic rules into line with EU law. Thus advance payments received since 1 January 2023 for supplies of goods are subject to VAT.

The same principle applies, namely that the date on which VAT becomes due on supplies of goods remains the date on which the trigger event occurs (the supply of goods). However, since 1 January 2023, where an advance payment is made before the goods are supplied, VAT becomes due upon receipt of the payment and on the amount received.

In the event of a transfer of a totality of assets between taxable persons, supplies of goods and services are exempt from VAT. In practice, the exemption regime implies not only the absence of VAT on the transferred assets, but also the non-adjustment of the VAT initially deducted by the seller.

In a recent decision, the Council of State considered that the transposition of the VAT Directive had been imperfect (EC 31 May 2022, no. 451379). The law has recast the directive to take account of the observations of the Council of State and ensure that the existing system is appropriate for the future.

From now on, no supply of goods or services is deemed to occur when a totality of assets is transferred between persons subject to VAT.

The period in which the reduced rate of 5.5% applies to masks, protective clothing and personal care products suitable for combating the spread of Covid has been extended to 31 December 2023.

For transactions where the trigger event occurs on or after 1 January 2023, the reduced rate of 5.5% will also apply to :

- foodstuffs intended for consumption by animals that produce food that is in turn intended for human consumption,

- products normally intended to be used in the preparation of these foodstuffs, and

- products normally used to supplement or replace such foodstuffs.

The reduced rate of 5.5% also applies to all agricultural, fishing, fish or poultry farming products for use in agricultural production.

Companies : Local taxes

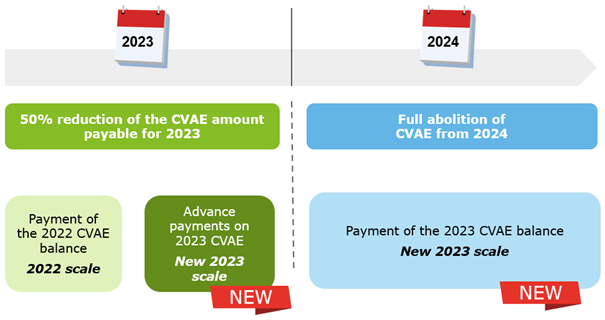

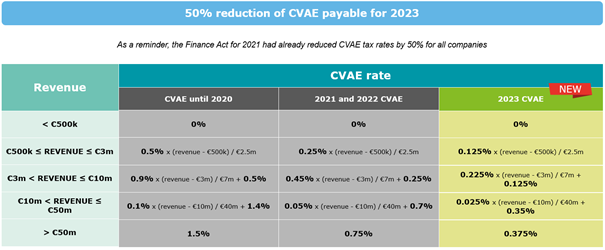

50 % reduction of CVAE payable for 2023

- Minimum amount of CVAE :

The minimum CVAE (payable by taxable persons whose revenue exceeds €500k) is also 50% reduced, from €125 to €63. - Additional rebate for small businesses :

The additional rebate for companies with revenue of less than €2 million is maintained and 50% reduced from €500 to €250.

Capping of CET based on added value

The local economic contribution (CET) cap based on added value, which will become a cap on the corporate property contribution (CFE) alone from 2024, is expected to be lowered by 2% :

- 1.625% in 2023

- then 1.25% in 2024

A specific tax is collected by CCI France and distributed between the regional chambers of commerce and industry. It consists of a supplement on the CFE (TA-CFE) and a supplement on the CVAE (TA-CVAE). The latter is based on the CVAE payable.

- The supplement on CVAE (TA-CVAE) is doubled for 2023 taxation from 3.46% to 6.96%.

- The supplement on CVAE (TA-CVAE) will disappear in 2024.

- For 2024 and subsequent years’ taxation, the levy for CCI costs becomes a supplement on the CFE alone.

Companies : Corporate measures

The exemption limit for the employer’s contribution to meal vouchers is raised to €6.50 for vouchers issued from 1 January 2023. In 2023, to be exempted from social contributions and individual income tax, the face value of the meal voucher must be between €10.83 and €13.

A propos de L'auteur

Vous avez aimé cet article, vous avez une question ? Laissez un commentaire